Quarterly rebates

Of the many variations of calculating rebates, a primary differentiator is the period of calculation and payout. This page explains how to calculate and pay or receive rebates in quarterly periods.

With the Amounts per > Quarter option, you can choose when your year starts, in other words, when you want the quarterly periods to begin. This can be the same as the rule validation date or a different specified date.

Calculations are only allowed for 12 months, regardless of when your year starts.

With quarterly rebates:

The cumulative total resets to zero every quarter.

The quarters start at the specified start of the year unless the calculation period is different.

When the calculation period starts in the middle of a quarter, the cumulative total from the start of the quarter to the start of the calculation period is calculated and used as the starting point. Then the rebate is calculated until the end of that quarter, and following in a regular pattern with other quarters. Hence, in some cases, the results would have more than four quarterly periods.

When the calculation period starts outside the rule validation date, the calculation period is trimmed to the rule validation period. The quarters are calculated as above.

Setup

In the rule setup Brackets section, select Amounts per > Quarter, then select where the quarters start:

On the rule start date: The quarters start on the same date as the rule starts (validation period start date). For example, if this is January 1, the first quarter will be from January to March, the next will be from April to June, and so on.

Other: This option allows you to set a date different from the rule start date. For example, if you select February 1, the first quarter will be from February to April, the next from May to July, and so on.

Example

In this basic example, two calculations are run for the same rule, yielding different results. The same calculation date range (Jan 1, 2022 to Dec 32, 2022) is applied to each calculation. The calculation start date is the same as the rule start date (Jan 1, 2022). The only difference is the date on which the quarters start.

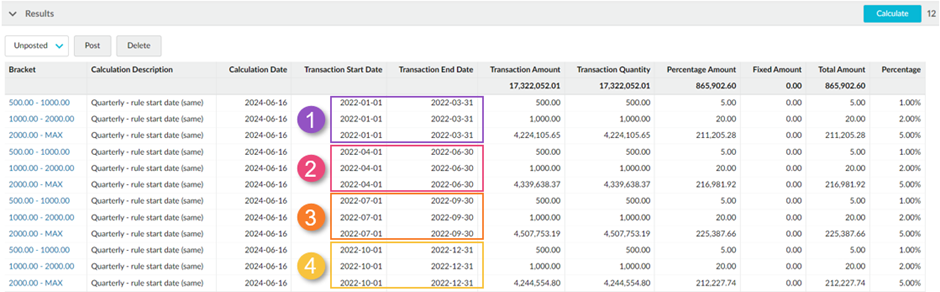

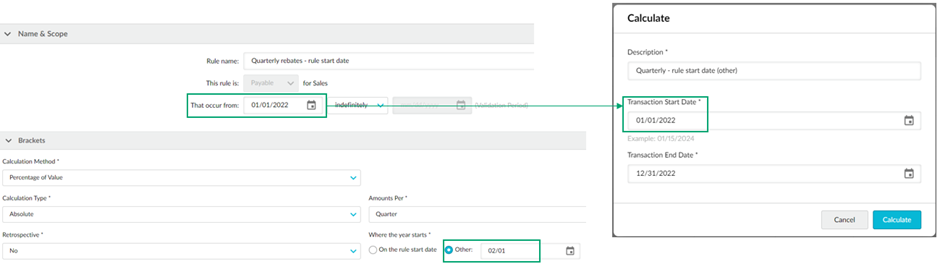

(A) Where the quarterly year starts on the rule date

Suppose you start the calculation on the same date as the rule and run for the whole calendar year (12 months). Your quarterly year also starts on the rule start date.

In the results, you can see the brackets are applied to the quarters. At the start of each quarter, the total resets to zero. There are 12 bracket rows, 3 for each quarter.

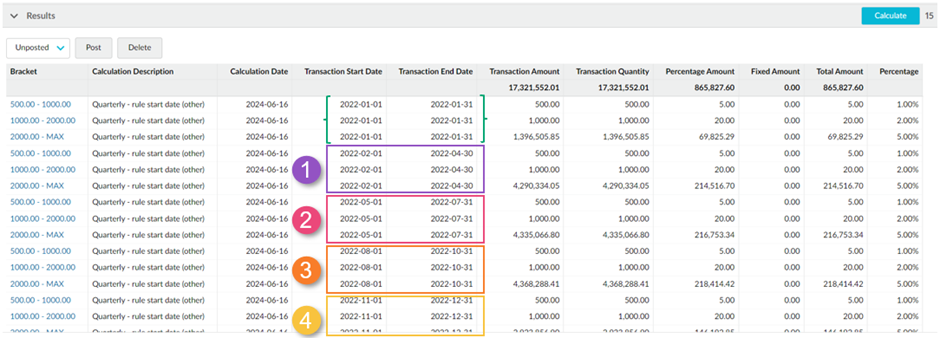

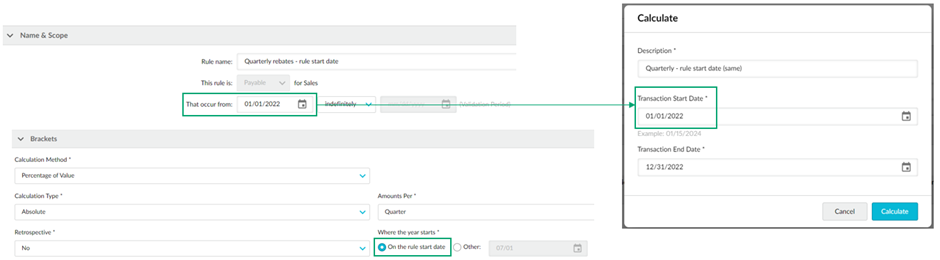

(B) Where the quarterly year starts on a different date

Suppose you start the calculation on the same date as the rule and run for the whole calendar year (12 months), however, the quarters start on a different date (February 1). In this case, some of the transactions (January 1 to 31) will fall outside the range of the quarterly year.

In the results, you can see the brackets are applied to the month of January and reset to zero for the start of the first quarter on 1st February. From there, the quarters are calculated as usual, resetting the total to zero each time. There are 15 bracket rows: the first 3 rows are for the month of January, and then there’s 3 rows for each quarter.