Whole rule period rebates

Previously, this option was called Year. It is not to be confused with the new Year option, which works differently.

Of the many variations of calculating rebates, a primary differentiator is the period of calculation and payout. This page explains how to calculate and pay or receive rebates for a period of less than a year.

The Amounts per > Whole rule period option is only available when the calculation type is Absolute, and the rule validation period (from start to end date) is less than one year (364 days or less).

This option allows you to calculate rebates for short periods of time (less than a year). It's suitable for when you want to set up rebate rules specifically for sales promotions or other special types of activities that occur within the year. It

The calculation period can be the same or shorter than the validation period and span calendar years.

With this method, if the start of the calculation period is different from the validation period start date, the cumulative total is calculated for the transactions from the start of the rule validation period up to the start of the calculation period and used as the starting point. Then, the transactions within the calculation period are added to that cumulative total and put into brackets accordingly.

Setup

In the rule setup, ensure the validation period is less than one year, and the calculation type is Absolute. In the Brackets section, select Amounts per > Whole rule period.

Example

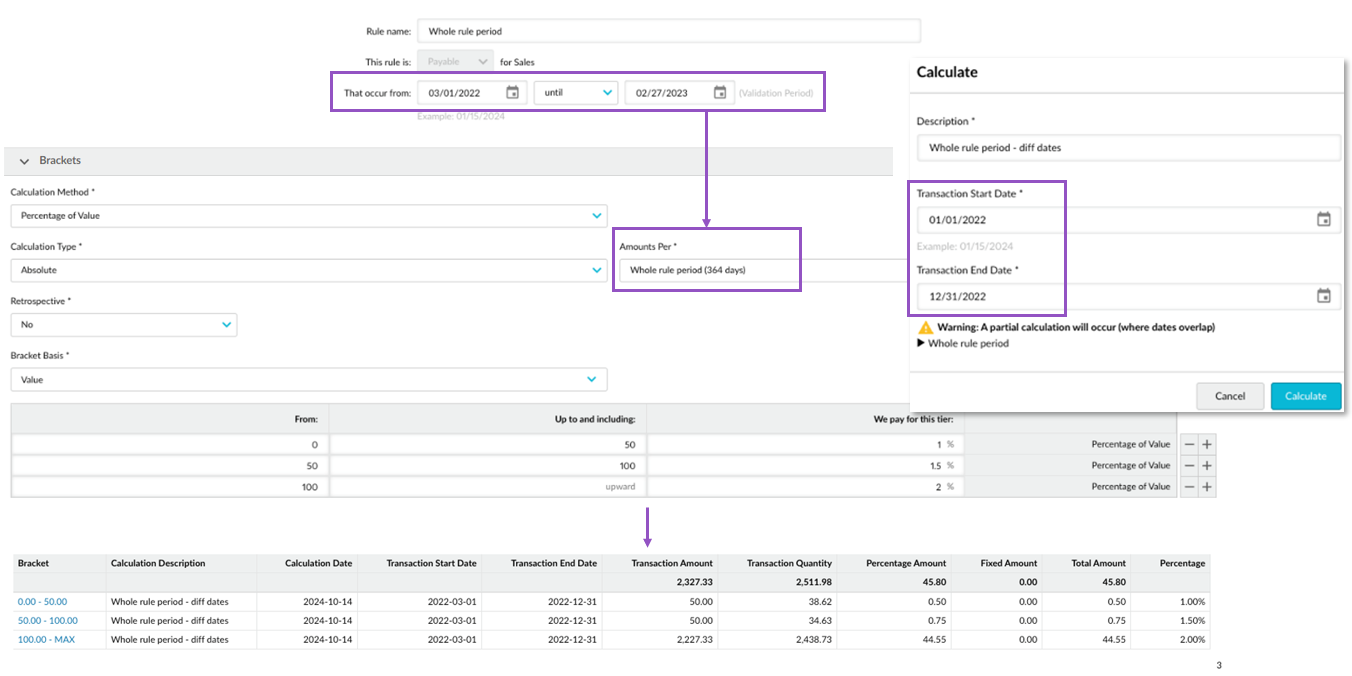

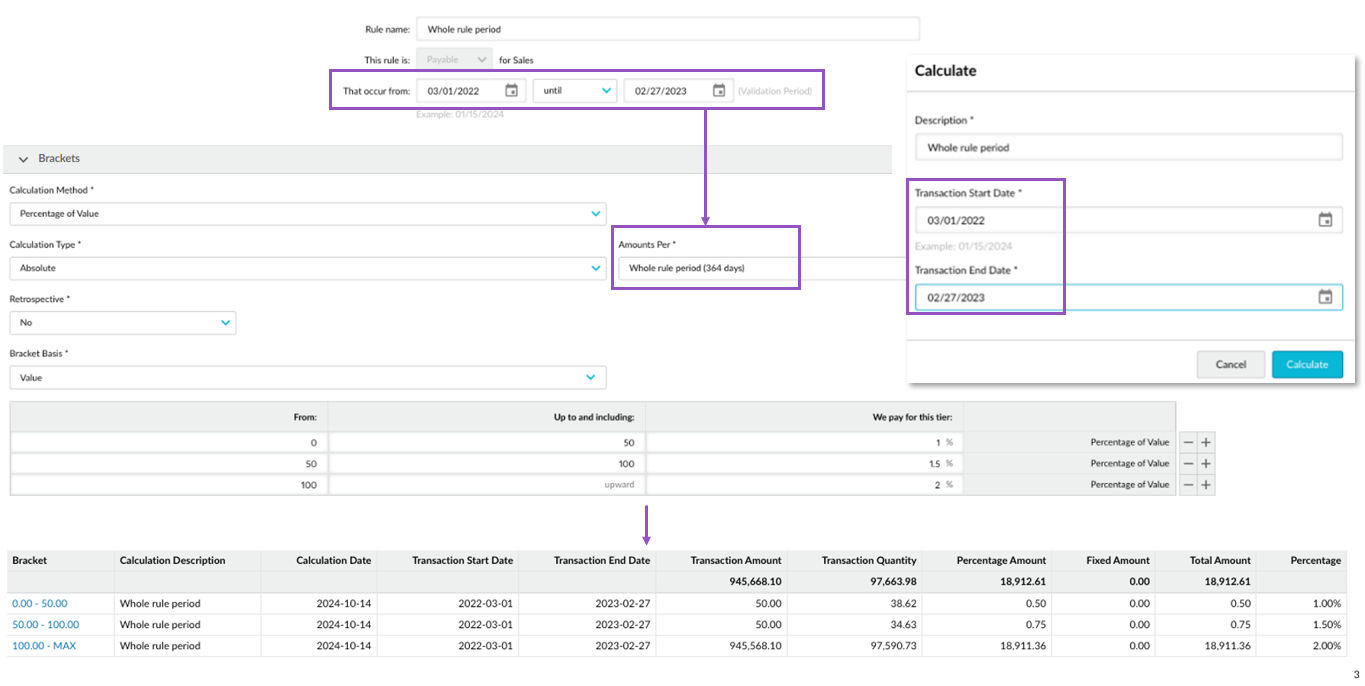

In this example, two calculations are run for the same rule, yielding different results. The rule validation period is March 1, 2022 to February 27, 2023. The calculation periods are different.

(A) Whole rule period

(B) Partial rule period

In this example, part of the calculation period falls outside the rule validation period, therefore, those transactions are disregarded. Only those transactions that fall within the rule validation period are considered for the calculation.