Edit the Balance Sheet budget

Learn about the unique characteristics of a Balance Sheet budget that impact the editing process.

Related pages

Add a Balance Sheet tab and Cash Flow tab (for budget owner and administrators)

Typically, you edit the Balance Sheet budget in the same way you edit the main budget, which means you can enter new values into any of the yellow cells and use formulas to calculate values and reference other cells and tabs. However, the Balance Sheet budget has some unique characteristics:

You will notice that the values in most account rows look the same across the periods. This is what keeps the Balance Sheet in balance.

There are some accounts in which the values always move in each period:

Cash (the account you selected in the budget setup) - Adjusts with any movements in the Balance Sheet.

Retained Earnings (the account you selected in the budget setup) - Adjusts with the movements in the profit in the Profit and Loss budget (Main tab).

If mini drivers were added to the Balance Sheet setup, the respective account rows also show movements in their values.

When you edit a cell in a Balance Sheet budget, the values in the period cells to the right of that cell update accordingly. You will also see movement in the Cash account row and, if you opted to create a Cash Flow budget, you will see your changes there too.

There are different ways to edit the values, giving you the flexibility to update the budget to respond to changes. These methods are: adjust the opening balance amount, add an adjustment row, and update mini drivers.

You cannot edit the Cash Flow budget, as it is derived from the Profit and Loss and Balance Sheet budgets. Any changes you make to those two budgets are automatically reflected in the Cash Flow budget.

Adjust the opening balance

Click the Adj Opening button to display the Adjustments column.

Expand the row in which you want to enter the adjustment.

Enter the adjustment (value) into the Adjustment cell in the required row and press Enter.

Watch the video in the introduction above for an example of how to adjust an opening balance.

Add a working or adjustment line

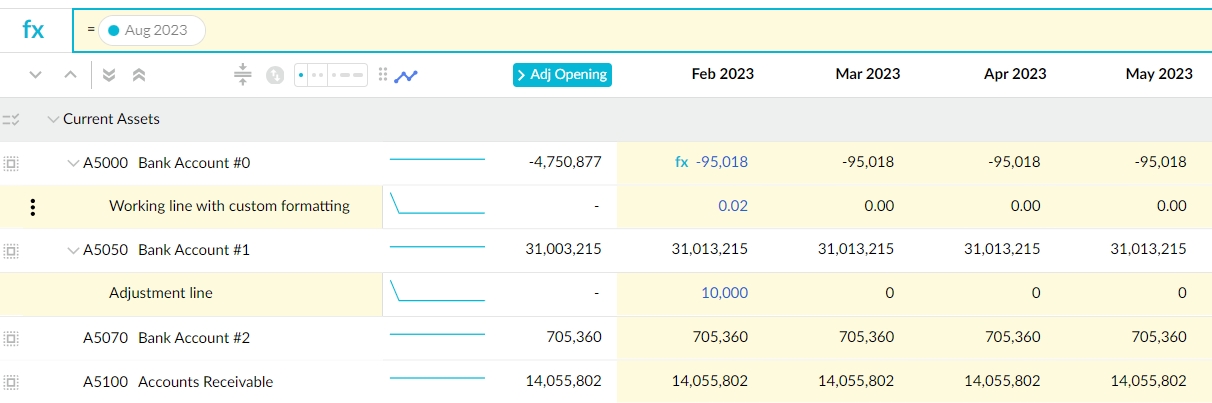

Use working or adjustment lines to add extra detail to the account (parent) rows on your Balance Sheet.

Working lines are a standard feature available in most other types of tabs. They are suitable for entering additional data for information purposes or for referencing in formulas in the account row. You can edit the measure format of the working line to include a prefix or suffix and determine the number of decimal places of the values. See Use sum and working lines for more information on how these lines work or follow these basic steps below.

Adjustment lines are unique to the Balance Sheet budget but work in a similar way to the sum line that’s available in most other types of tabs. They’re suitable for modeling unfrequent events, such as the purchase of a new asset or the early repayment of a loan. They’re also useful when you want to budget at a more granular level than the account level. You enter values or formulas into the adjustment row, and the values in the account row update automatically. A hidden sum line sits under the adjustment row, which references the column on the left, and as a result, the values in all the columns to the right update automatically. Watch the video in the introduction above for an example of how to add an adjustment row and see its impact, or follow the basic steps below.

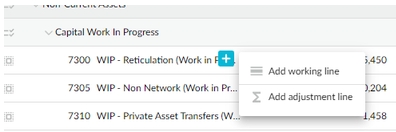

Locate the account row for which you want to add the working or adjustment line.

Hover over the account name, click the blue Add button, and select Add working line or Add adjustment line as required. The new line displays underneath the account row.

Click in the new line under the account name and enter a name for the adjustment row.

Proceed to enter the values or formulas in the applicable period cells.

Adjust the mini driver rows

Mini drivers are unique to the Balance Sheet budget and need to be added to the Balance Sheet setup. They are suitable when you have certain KPIs you want to watch, often based on complicated formulas. You adjust the values in the mini driver rows and the inbuilt formulas update accordingly.

Expand the row containing the mini driver, enter the new value into the applicable mini driver cell, and press Enter.

This video shows how the use of a stock (inventory) mini driver automatically drives movement in the Balance Sheet and how a change to its value directly impacts the cash movement.

Next steps

As with other types of budgets, when your Balance Sheet budget is complete, you can publish it to a stream to make it available in Financial Statements.

Publish a Balance Sheet budget

In addition to publishing the Main tab, you must publish your Balance Sheet budget as a separate stream in the underlying database. See Publish a budget workbook.

View the Balance Sheet (and Cash Flow) budget in Financial Statements

After you publish the Balance Sheet budget as a stream, you can add it to a budget package in Financial Statements. See Manage streams and scenarios (in Financial Statements).

As the Balance Sheet stream uses balance brought forward logic, the opening balance is published along with the movements for the period, so you can view the Balance Sheet position at the relevant date in Financial Statements.

When you link the Profit and Loss and Balance Sheet budgets in a budget package in Financial Statements, the Cash Flow budget is derived automatically for you.

Last updated