Set the financial year end date

The financial year end data impacts your financial statements in different ways, as explained in the following expandable sections. After you set your year end date, you can add other dates as required. You can edit those dates later.

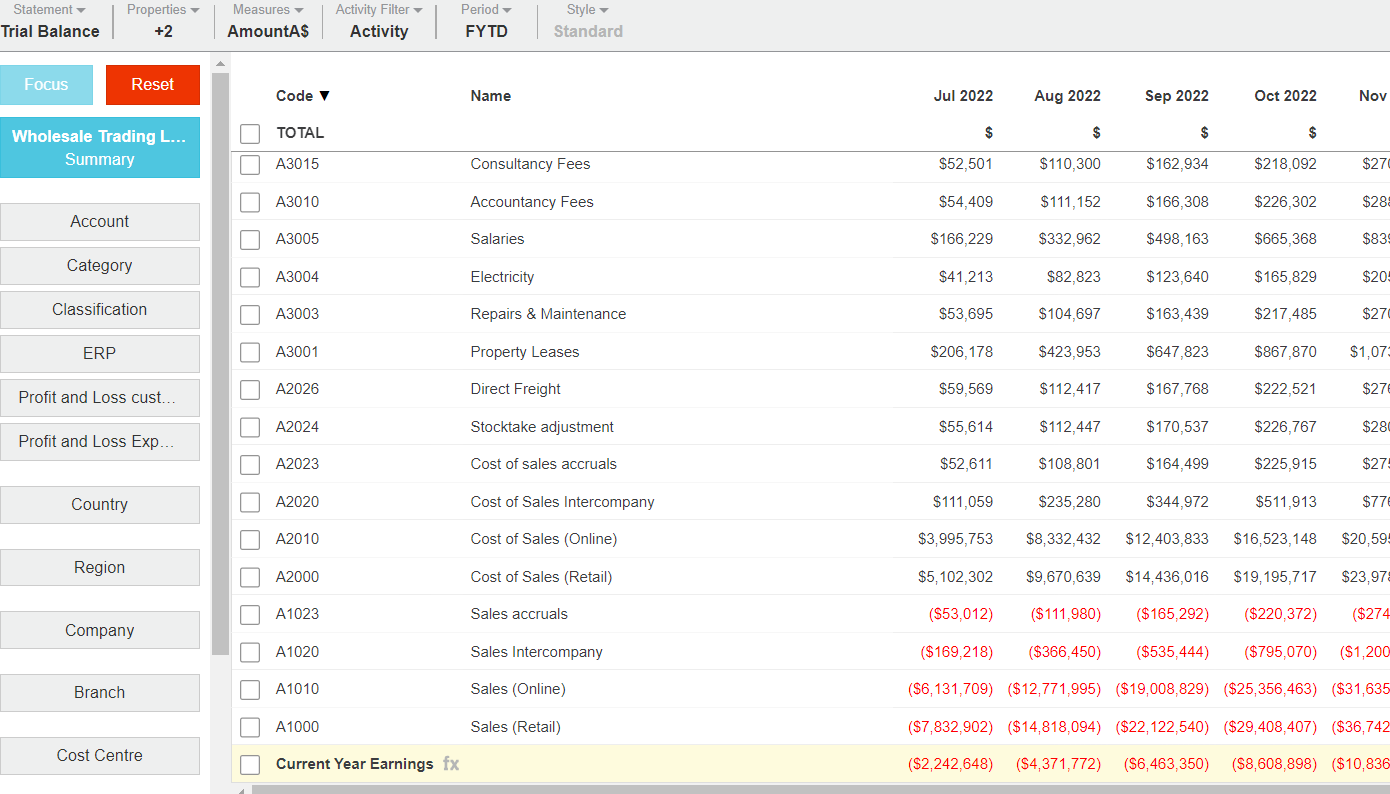

Trial Balance statement

The Trial Balance displays the end of period balances, in particular:

For the Balance Sheet accounts, it displays the total balances.

For the Profit and Loss accounts, it displays the balances since the start of the financial year.

For the Retained Earnings account, it excludes Profit and Loss movements during the financial year. The current year earnings is displayed for information purposes, which forms the sum of the Profit and Loss accounts.

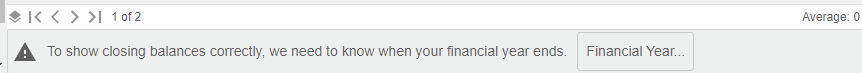

To ensure the closing balances in the Trial Balance are correct, you need to set your financial year end date. When you and other users open your Trial Balance, if the financial year end date is not set, you will see a warning message at the bottom of the screen. Users with permission to manage financial statements will also see a button you can click to set the date.

When you set the date, the warning message no longer displays. You can then edit the date or add more dates via the Settings button, as outlined below.

Troubleshooting: If after setting the financial year end date, your Trial Balance statement still doesn’t balance or there are differences between your Trial Balance in Phocas and your ERP, it’s likely there’s a data integrity issue. If possible, try to identify the account(s) and the time when the issue arises, then contact our Support team, who can make the necessary changes in the database.

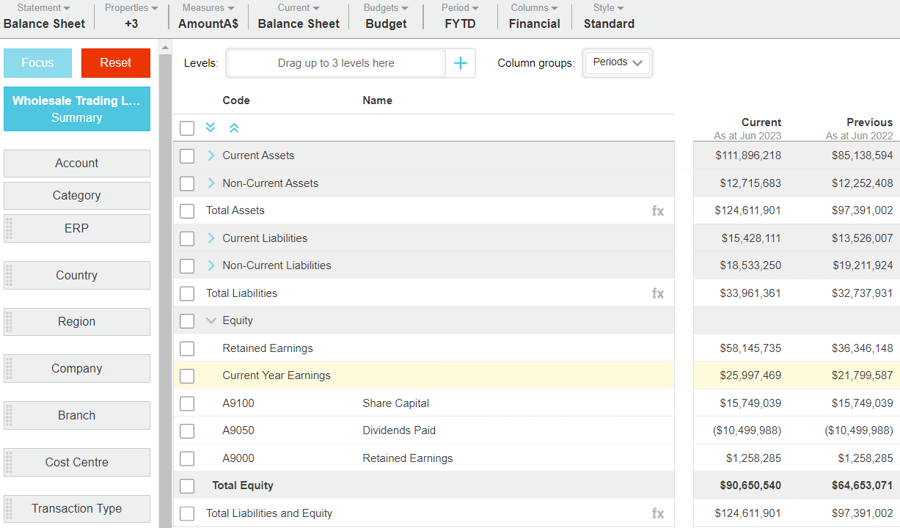

Balance Sheet statement

By setting the financial year end date, the current year earnings displays on the Balance Sheet, mapped to the same location as the Retained Earnings account.

Retained Earnings

Analytics forms the base value, which is calculated as follows:

Retained Earnings appears on the Balance Sheet stream and can be mapped to an existing account code(s) via the steps below. If left unmapped, it is displayed as the Retained Earnings system account.

Retained Earnings is the sum of all the P&L transactions within the P&L stream plus any relevant Balance Sheet transactions. It is calculated as A + B, where: A = Sum of all transactions for all dates for P&L accounts from the database start date to the end of the current period. B = The amount already in the Retained Earnings account, such as the opening Balance Sheet value and other transactions, such as a dividend payment.

In Financial Statements, if the financial year end has been set, the Retained Earnings value is adjusted by the Current Year Earnings, which appears as a separate row on the Balance Sheet statement.

Select one of these methods as applicable:

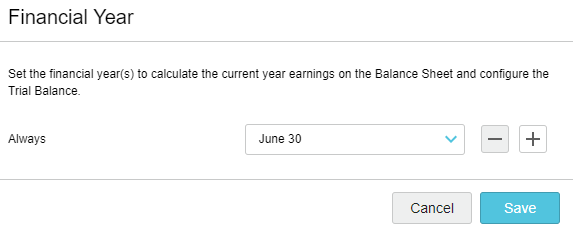

Click the Financial Year… button in the warning message.

Click the Settings button > Financial Year in the top right corner.

In the Financial Year window, select the required year end date from the list, for example June 30. If your year end date does not display in the list, select the Other option, then specify the date.

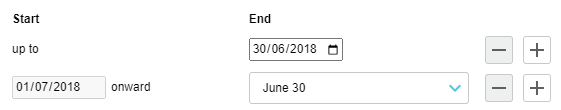

(Optional) Add another year end date. You can add as many as required. Click the Add button, then specify the date range and select the year end date (as above).

Click Save.

Refresh your browser or click the Reset button, then open the Trial Balance again to view your changes.

To edit the financial year end dates later, click the Settings button > Financial Year in the top right corner, then edit the date(s) as required.

Last updated